Many individuals in our country don’t own their personal homes, and monthly rent payments form a significant part of their budget. It is usually among their highest expense, and they can pay it with their credit card. In the past, landlords always preferred receiving payments in cash, while some people used NEFT, IMPS, etc., but now the focus is more on digital, paperless transactions. Traditionally, landlords have been reluctant to share their bank account details. However, following the COVID-19 pandemic, digital transactions increased, and people began paying their rent with credit cards, mobile wallets, and other methods. Various third-party apps are available that allow you to pay your home rent using your credit card, even through UPI.

It is recommended to use your credit card to pay rent only if you are certain to pay off your dues in a timely manner; otherwise, you may fall into a debt trap. Many banks have now added charges to discourage third-party rent payments. In this article, we will examine every detail related to making rent payments via credit card, including how to do it, processing fees and charges, available offers, and more.

Latest Offers on Rent Payments – June 2025

MobiKwik

- Use code ‘RENT500’ and get 2% supercash up to ₹500 on making rent payments with credit cards on MobiKwik. The minimum transaction value is set at ₹5,000.

- Those who have completed their KYC on MobiKwik shall be eligible for cashback of up to ₹250 on rent payments made through the credit card mode.

CRED

- Assured cashback up to ₹1,000. Simply pay your rent on CRED via UPI (also valid on other modes of payment) and claim the jackpot from the rewards section of the app. This offer is applicable once per user.

- Get a 15% discount on rent payments via HDFC Tata Neu Visa Credit Cards on CRED. A maximum discount of ₹500 can be availed once per user during the offer period.

- Get a 15% discount on rent payments via HDFC Tata Neu RuPay Credit Cards on CRED. A maximum discount of ₹50 can be availed once per user during the offer period.

- 5% off up to ₹500 on service charges while paying rent through Visa Credit Cards.

No Broker

- Get cashback of up to ₹500 on rental payments made with No Broker.

- 30% additional discount on top brands and platforms like Zomato and Amazon.

RedGirraffe

- Make your rental payments and earn 5% of the transaction value as RedGirraffe CASH Points. The maximum cap is 3,000 RedGirraffe CASH Points.

Housing.Com

- Get 100% cashback upto ₹500 on convenience fees while making your first rental payment with Housing.Com.

News on Rent Payments

March 2024

SBI Credit Cards shall no longer be awarded Reward Points for payments made towards rent from 1st April 2024. Earlier, co-branded credit cards were not included in this, but now all co-branded SBI Credit Cards shall no longer accrue any Reward Points from 15th April 2024. It is advised that those who own a co-branded SBI Credit Card, like the SBI Vistara Card, make payment before the last date.

Bank Processing Charges on Rent Payments via Credit Cards

Here are the processing fees charged by major banks and card issuers on paying rent with your credit card and the reward points you can earn on the payments–

| Card Issuer | Processing Charges | Cards that Offer Rewards on Rent |

| Axis Bank | 1% + GST | Primus |

| HDFC Bank | 1% + GST | None |

| SBI Card | ₹199 + GST | None |

| ICICI Bank | 1% + GST | None |

| BOBCARD | 1% + GST | None |

| Kotak Mahindra Bank | 1% + GST (2% for Kotak 811 #DreamDifferent and White Credit Card) | None |

| AU Bank | 1% + GST | None |

| Standard Chartered Bank | 1% + GST | 2% for Ultimate |

| HSBC Bank | 1% + GST | None |

| RBL Bank | 1% + GST | None |

| IndusInd Bank | 1% + GST | None |

| IDFC First Bank | 1% + GST or a Minimum of ₹249 | 3X/₹150 Reward Points on Rent With Ashva and Mayura Credit Cards |

| Yes Bank | 1% + GST | None |

How to Pay Rent Via Credit Card?

It is relatively easy to pay rent to your landlord’s account with your credit card, but you will have to use a third-party rent application. Almost every application for paying rent follows a similar process, and you will need to provide some information, including your details, credit card details, property details, rent amount, and the landlord’s account details.

Here is how you can pay rent on any third-party rent payment application using your credit card–

- Download a rent payment app and register using your basic personal details.

- You will have to enter your landlord’s details like mobile number, account number, IFSC Code, PAN number, etc.

- Some applications may also ask for property details like address, rent agreement, etc.

- After adding your landlord as a payee on the application, you can proceed with the payment. Enter your credit card details and complete the transaction.

- You can even set standing instructions for auto-payment, and the rent amount will be automatically transferred to your landlord’s account on your specified date.

Almost every rent payment application follows a similar payment process, and you can use any application that you like. Next, we will take a look at the best 3rd-party rent payment applications that you can use to pay rent with your credit card.

Best Rent Payment Applications and Platforms

A merchant needs a POS terminal or an online payment getaway to receive payment through a credit card. A landlord will generally not have these. Therefore, a rent payment platform has to be used to make payments with your credit card. You add your landlord’s account details in the application, and the application sends the money to his account.

There are several rent payment applications that you can use, and we will talk about the best options available –

Cred

Cred is one of the most-used credit card bill payment applications that rewards its users for making timely payments of their credit card bills. You can use the application to pay your rent, and you will earn cashback and other rewards when you make the payment. It features a sleek, user-friendly interface and can be used to pay UPI IDs as well. Also, depending on your credit card network, you will be charged 1-1.5% as processing fees.

Here is how to pay rent using your credit card via Cred –

- Download the Cred mobile application on your smartphone and sign up using your details.

- Click the Pay option in the bottom bar and then select the Rent Pay option.

- Enter your rent amount. The final amount will also include processing charges in addition to the rent amount.

- Next, click ‘Proceed with your credit card’ and enter your credit card details in the necessary fields.

- Enter some basic details regarding your landlord, like name, phone number, and banking details. You can provide either bank account details or the UPI ID.

- Click on Proceed to payment next and complete the process.

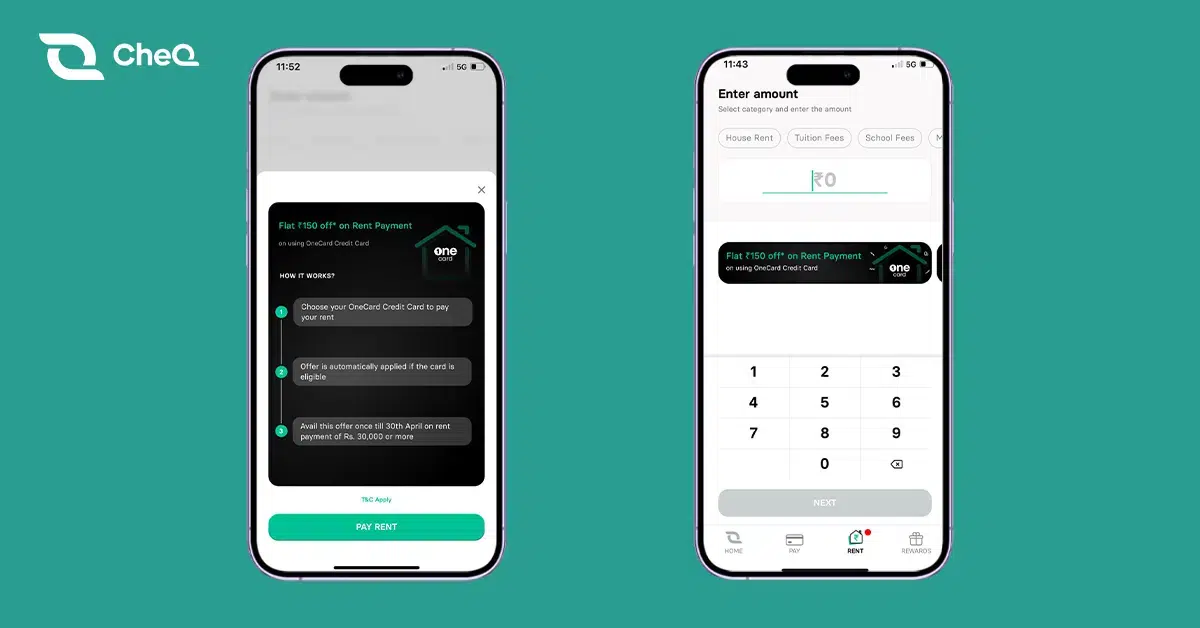

CheQ

Although the CheQ app is primarily known for its rewards on credit card payments, it also enables easy rent payments.

- Simply download the app from the app store.

- Login with your details.

- You would then need to select the “House Rent” option.

- Enter the rent amount.

- In the next step, you will have to enter the recipient’s details, such as name and account number.

- After agreeing to the terms and conditions, you can easily complete your rent payments.

RedGiraffe

RedGiraffe is a popular and highly dedicated rent payment app that was one of the first ones to offer the service. The user experience can be better, but the app has integration with multiple banks and offers a very low processing fee compared to other applications. If your rent is above Rs. 20,000, you will need to upload your rent agreement.

- Visit the official Redgiraffe website and click on Get Started under RentPay.

- Click on Credit Card and then choose RentPay out of the available options.

- You will see the Pay My Rent page. First, add the tenant details along with the address.

- Enter the rental details, including rent amount, rent agreement expiry, etc.

- Next, you have to enter the owner’s information and his bank account details.

- Upload your rent agreement and click on Next.

- Enter your credit card details and proceed to make the payment.

Housing.com

Housing.com provides customers with a user-friendly and simple rent payment feature. You must download the app to make rent payments, and you must make a minimum payment of Rs. 3000. The signing-up process is easy and doesn’t require any documents, and the rent payment is usually settled within an hour.

- Visit the official Housing.com website and click on the Pay on Credit option. Next, click on the House Rent category.

- Enter your mobile number and verify with the OTP.

- Enter your Rent Amount along with the landlord’s bank account details.

- Next, enter your credit card details and click on Pay Now to process the payment.

- The transaction will be completed within 24 hours and reach your landlord’s account.

Freecharge

A platform by Axis Bank, Freecharge is a nice payment app through which you can pay your rent easily via your credit card. It is simple to send money to your landlord’s bank account just by entering minimal details and making the payment with your card. Here is how you can pay rent on this platform –

- Open the official Freecharge website and click on Rent via Credit Card

- Enter your mobile number and then enter the OTP for verification

- Enter your personal details like name, email ID, pin code, and then Proceed

- Next, you have to enter the recipient’s name, mobile number, and bank account details

- Enter the rent amount, property address, and other required details

- Next, you can enter your credit card details and proceed with the payment.

NoBroker.com

A real estate application through which you can sell, purchase, and rent properties. The app allows you to pay society maintenance and rent using your credit card. Use your Mastercard or Visa credit card to make rental payments on the app and earn exclusive rewards. Here is how to pay rent on this platform –

- Visit the official NoBroker website and click on Pay Rent with Credit Card

- Enter your mobile number and verify it with the OTP

- Enter your landlord’s basic information and bank account details.

- Enter your rent amount and proceed to the next step

- Enter your credit card details and complete the payment.

Rent Processing Fees of Different Apps

| Rent Payment Platform | Processing Fees |

| Cred | 2.5% |

| Redgiraffe | 0.39% |

| Housing.com | 1.5% |

| No Broker | 1% |

| Freecharge | 1.1% |

What to Consider Before Making Rent Payments with Your Credit Card?

Credit cards charge a very high interest rate, so there are various factors you must consider before you pay your house rent via credit cards. Here are the most important ones –

Impact on Credit Score – Rent payment is usually a considerable amount of money. When you pay it with your credit card, your credit utilization ratio is sure to increase. This ratio is important as a high ratio can negatively affect your credit score.

Processing Fees – When you make a rent payment using your credit card, the card issuer company or bank will charge a transaction or processing fee for the service. The fee can be anywhere between 1 and 5%, so you will have to pay a high processing fee if your rent payment is high.

Interest – Credit cards charge a high interest rate. If you do not pay your card bill on time, a high interest will be charged to your outstanding dues, which will keep increasing over time. When you pay rent with your credit card, make sure you are well-equipped to clear your credit card dues on time.

All of these factors are vital to take care of because you need to be careful when paying rent with a credit card to avoid your credit score taking a hit, and you may end up paying a high amount of interest. Only use your credit card to pay rent when you are confident about paying off your bills on time.

Pros of Paying Rent via Credit Card

There are several benefits of making your rent payments through a credit card. For some people who have to pay their rent on a date before they receive their salary, it is a great option. You can also earn several benefits and reward points from using your credit card.

Benefits & Reward Points – Almost every card offers certain advantages and reward points when you spend money with it. You can earn reward points by making your rent payment with the card, and these points can be redeemed as cashback for flight/hotel bookings, purchasing products, gift vouchers, etc. Some card issuers also have exclusive offers for rent payments with credit cards, and you can reap their benefits.

Easy Money Transfer via 3rd Party Apps – You don’t need to withdraw money from an ATM or go to the bank to fill out forms and cheques to make your rent payment. You can use your credit card for rent payments through reliable 3rd-party applications like Cred, Housing.com, RedGiraffe, etc. You can make the payment with minimum formalities and convenience. You can set standing instructions through these apps, and your rent payment will be automatically transferred on the specified date.

Timely Payments – Certain people receive their salary on the 7th or 15th of each month, and they may have to pay their rent on the 1st or 3rd. A credit card will help you make timely rent payments in such cases. Also, you can set standing instructions, and your rent will be automatically paid through your credit card on the specified date. You don’t have to remember any due dates and will not forget any payment.

Improve Your Credit Score – You can utilize your credit limit to pay rent and make timely repayments to improve your credit score. Make sure not to use more than 30% of your card limit, as it can negatively affect your credit score. Also, if you think you may face issues in repaying your card dues, avoid using your credit card to pay rent and opt for cash or an account transfer.

Achieve Spend-Based Milestones – Most credit cards these days come with milestone benefits like annual fee waivers and attractive rewards upon spending a determined amount of money. Usually, house rent is high, and you will earn reward points when making the payment. You can even waive your credit card renewal fee by reaching a certain spending milestone.

Cons of Paying Rent via Credit Card

There are no doubt many advantages to paying rent through credit cards, but there are several disadvantages associated with it, too.

High Credit Utilization – House rent is generally a high amount, which means your credit utilization ratio can increase a lot. Your credit score will be negatively affected when you utilize more than 30% of your card limit. In such cases, you will find it difficult to get loans or get approved for new credit cards in the future.

Higher Bill Amounts – If your home rent is very high, it will increase your credit card bill by a lot, and it also may go out of your budget. In case of a high bill, you may find it very hard to pay your entire card bill or even the minimum amount due. This affects your credit score, and high interest is charged on the outstanding amount.

Missing Payments – You may try to make your rent payment with your credit card, but it may not succeed in some situations. It is possible that you have exceeded your allotted card limit or your credit card has expired. You will miss payments in this case and will have to look at other payment methods.

High-Interest Rate – Credit cards charge a very high interest rate on your outstanding dues. If you are unable to clear dues on time, a very high amount will be charged as interest, and you can fall into a vicious debt trap.

High Processing Fees – Almost every bank or card issuing company charges a certain processing fee for paying rent with your credit card. The fees can range between 1% to 5%, and if your house rent is very high, then you will have to pay a very high processing fee as well. Third-party apps used to make the payment also charge convenience fees from customers.

Conclusion

If you are considering paying your house rent with your credit card, make sure to consider the advantages and disadvantages we talked about above. Rent payments via credit cards can be great for some, but they can land others in a debt trap. If you are sure about repaying your dues on time, you can pay rent through credit cards and earn exclusive reward points and other benefits.

Different banks charge and offer different offers for rent payments through credit cards, so make sure to keep yourself updated about them. Also, there are many rent payment platforms, and you should choose one that is convenient to use and offers exciting benefits, cashback, and other rewards. With our country rapidly switching to digital payments, rent payments via credit cards are certainly something to consider. However, if your financial condition is not good, you should refrain from using your credit card to pay rent, or your credit score can be negatively affected, and you may get into a mountain of debt.

Read Also- Rent Payments With Your Credit Card May 2025