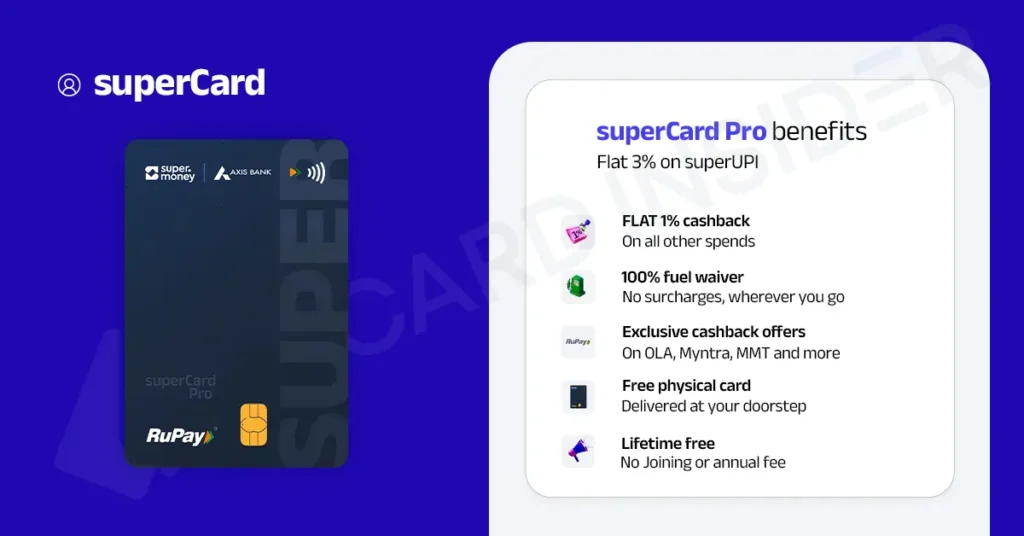

UPI has become the most common way to make payments in India. From street vendors to big online stores, everyone accepts UPI. But did you know you can now earn cashback every time you pay using UPI? Yes, with the Axis SuperMoney RuPay Credit Card, launched by Axis Bank in partnership with super.money by Flipkart, you can earn up to 3% cashback on UPI payments.

Most credit cards in India don’t offer cashback on UPI transactions. This card changes that. It’s lifetime free, offers a free physical card, and gives extra cashback on brands like Ola, Myntra, MakeMyTrip, and more. This makes it an excellent option for young users, digital spenders, and those who want to earn rewards on everyday spending.

In this article, you’ll learn everything you need to know about this new credit card: benefits, eligibility, how to apply, cashback limits, and more – all in simple, easy-to-read language.

🔍 What is the Axis SuperMoney RuPay Credit Card?

The Axis SuperMoney RuPay Credit Card is a lifetime free credit card designed to reward users for spending through UPI. It’s powered by the RuPay network, which means you can link it to UPI apps like PhonePe, Google Pay, BHIM, and more.

This card gives:

- 3% cashback on UPI transactions

- 1% cashback on all other regular transactions

- Extra cashback on top brands

- 100% fuel surcharge waiver

- No joining or annual fees

It is an upgraded version of the earlier super.money secured credit card and is better suited for users who already have some credit experience.

🎯 Why is This Card Important for You?

Here are some strong reasons why you should consider the Axis SuperMoney RuPay Credit Card:

- You regularly use UPI for payments.

- You want to earn cashback for every UPI transaction.

- You prefer a lifetime free card with no hidden charges.

- You want extra cashback on brands like Ola, Myntra, and MMT.

- You are looking for a reliable Axis Bank product with RuPay UPI support.

💳 Key Benefits of the Axis SuperMoney RuPay Credit Card

The card offers several benefits. Let’s go through each one with short explanations:

✅ 1. 3% Cashback on UPI Spends

If you use UPI regularly, this is a huge benefit. Most other cards don’t give cashback for UPI, but with this card:

- You get 3% flat cashback for payments made via UPI linked to RuPay.

- Works on apps like PhonePe, Paytm, Google Pay, etc.

🔔 Maximum cashback per billing cycle is ₹500.

✅ 2. 1% Cashback on All Other Spends

Besides UPI, you also get:

- 1% cashback on every other transaction like shopping, dining, groceries, etc.

- No categories excluded (except the blocked list mentioned later).

✅ 3. Brand-Specific Offers

The card brings exclusive cashback offers on:

- Ola

- Myntra

- MakeMyTrip

- Other super.money partner brands

These offers are updated regularly within the app and website.

✅ 4. Lifetime Free & Physical Card

- No joining fee

- No annual fee

- Free physical card for offline and online purchases

✅ 5. 100% Fuel Surcharge Waiver

Fuel surcharge can be annoying, but with this card:

- You get a full 100% waiver on fuel surcharge at petrol pumps.

- Cashback not applicable on fuel, but surcharge is waived.

🚫 What Is Not Eligible for Cashback?

Cashback will not be given for the following types of transactions:

- Fuel purchases

- Jewelry buying

- Wallet reloads

- Insurance payments

- Education-related fees

- Government payments

- Rent payments

- EMI transactions

- Cash withdrawals

❗ Always check your transaction category before expecting cashback.

🧮 How Much Should You Spend to Maximize Cashback?

To get the maximum ₹500 cashback per cycle, spend:

- ₹16,667 via UPI (3% cashback of ₹500)

For regular transactions:

- ₹50,000 on non-UPI spends gets ₹500 cashback (1% rate)

This card is perfect for users who spend moderately but regularly using UPI.

🏦 Card Issuer Details

- Issuer: Axis Bank

- Network: RuPay

- Partner: super.money (by Flipkart)

- Card Type: Unsecured Credit Card

- Card Tier: Entry to Mid-Level

📲 How to Apply for Axis SuperMoney RuPay Credit Card

The application process is completely online and simple:

- Download the super.money app.

- Complete KYC and onboarding.

- Check eligibility for the Axis SuperMoney Credit Card.

- Fill in personal and financial details.

- Get card approval and delivery after verification.

📦 Physical card will be shipped to your address. Virtual card is issued instantly.

📌 Axis SuperMoney RuPay Credit Card – Key Highlights

| Feature | Details |

|---|---|

| Cashback on UPI | 3% |

| Cashback on Others | 1% |

| Cashback Cap | ₹500 per cycle |

| Annual Fee | ₹0 |

| Network | RuPay |

| Fuel Surcharge | 100% Waiver |

| Physical Card | Yes, Free |

| Maximize Cashback | ₹16,667 UPI spend |

✅ Pros and Cons

👍 Pros:

- High cashback on UPI

- Lifetime free with no hidden fees

- Physical and virtual cards

- Trusted partner – Axis Bank

- Easy to use via super.money app

👎 Cons:

- Cashback cap of ₹500 per month

- No rewards on wallet, fuel, rent, etc.

- UPI spends must go via RuPay-linked apps

❓ Frequently Asked Questions (FAQs)

Q1. Is the Axis SuperMoney RuPay Credit Card really lifetime free?

Yes, there are no joining or annual fees.

Q2. Can I use this card on PhonePe or Google Pay?

Yes, as long as your UPI app supports RuPay credit card linking, you can use it.

Q3. How do I get 3% cashback?

Make UPI payments using this credit card via RuPay. The cashback is added to your statement.

Q4. What’s the monthly cashback limit?

You can earn up to ₹500 cashback per billing cycle.

Q5. Is there any fuel cashback?

No cashback on fuel, but you get 100% surcharge waiver.

Q6. What is the interest rate on this card?

The interest rate is 55.55% per annum if you don’t pay your dues on time.

Q7. Is this card available to everyone?

Most salaried individuals and self-employed professionals can apply. Your eligibility depends on your credit profile.

Final Thoughts

The Axis SuperMoney RuPay Credit Card is a smart choice for modern users who love UPI payments and want maximum value on everyday spends. It’s especially good for those who:

- Pay mostly via UPI

- Want simple cashback benefits

- Don’t want to pay yearly fees

- Like shopping on brands like Myntra or MakeMyTrip

With features like 3% UPI cashback, a ₹500 monthly cap, and zero fees, this is one of the most rewarding and user-friendly credit cards available in India today.

Read More Blog- Find My Swipe